Faster, easier, more accurate. This is payroll done right, every time.

An efficient and stress-free pay cycle isn't a distant dream. Our payroll system does the heavy lifting. You focus on the marathon of an evolving business, not a monthly sprint to payday. P45s, pensions and everything in between. Payroll from MHR is the perfect fit for small and large organisations within the UK, Ireland and internationally.

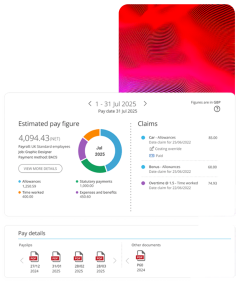

Get people paid on time, every time with real-time payroll

Payroll content from the Knowledge Hub

Payroll software FAQs

-

Many employees in the UK risk falling into debt between paydays, with 35% of workers having less than a month's income saved.

Happy employees make for a productive and resilient workforce, and you'll reap the benefits when our payroll software is in place.

Through our partnership with Wagestream, we offer earned wage access (EWA) alongside a wider suite of financial education tools and empowering resources. This takes any mayday out of payday.

Find out more about the financial wellbeing benefits of our partnership with Wagestream.

-

Yep! iTrent seamlessly integrates with Wagestream to cure those payroll and HR blues. This includes earned wage access, also known as 'pay-on-demand'.

The integration between iTrent and Wagestream means you can look forward to seamless set-up and data flow of staff and salary information with no impact on current payroll processes.

You can find out more about Wagestream and our partnership.

-

Absolutely. Alongside our payroll platforms, we offer accurate UK-based payroll services to get your business all the way through payday. They include:

- Payroll processing

- Fully managed payroll

- Transactional support for smaller payroll runs

- Emergency payroll

Discover more about MHR's payroll services and how we can help you improve accuracy can be found.

-

Don't wait, just get in touch. Things can go wrong. Unforeseen circumstances can lead to disruptions. With a critical function like payroll, you can't afford problems when employees need to be paid.

We provide emergency payroll support to counter these possibilities.

Find out more about how our emergency payroll support works.

-

You can't put a price on outstanding HR efficiency, but ROI certainly helps. How much heavy lifting we'll do will vary depending on the size of the business, the type of software and the level of support required.

Don't get us wrong; it's a major investment but payroll software provides excellent ROI by significantly reducing manual tasks and freeing up time.

On the fence about us? See what some of our customers say about our extensive portfolio of business products and services and the improvements we've helped drive.

-

We're always on hand to offer all the implementation support you need. This is alongside ongoing customer support services through a dedicated account manager.

Our customers get exclusive access to a dedicated service desk team and customer portal FAQs, support materials, managing support tickets and access to all software updates and improvements.

Our commitment to stellar service is reflected in our 98% customer loyalty rate.

-

Get ready for more lunchtime at payroll crunch time. iTrent is a configurable cloud-hosted payroll, HR and finance software system. Just adjust the setup to your specific business requirements.

People First is our real-time payroll system which provides a streamlined payroll service.

We also offer outsourced payroll services, so that any business can benefit from a first-class, accurate, fully managed payroll.

-

Yes. We've got everything you need for reporting on almost any element of payroll, including bespoke report packs for individual business needs.

iTrent also integrates with other BI solutions like SAP Business Objects and Microsoft Power BI to offer the highest levels of reporting, forecasting and data processing.

Discover more about our data analytics and reporting solutions.

-

We won't get bogged down in the intricacies of iTrent and People First. You can just think of them as payroll without the eyeroll. Plan, manage and engage with your employees while reducing the time-consuming admin.

Just think: automated pensions, holidays, expenses, P60s and payroll processes. We'll free up time spent on manual tasks whilst giving you peace of mind that you can avoid any surprises come payday. To top it off, all our business software solutions can be fully integrated for easy use and little-to-no adjustment time.

-

Every and any. Our payroll software as a service (SAAS) simplifies time-consuming admin, improves payroll processes and reduces rage, stress and exhaustion within your HR team. Whether that's a one-man band or an army of HR pros.

iTrent, our payroll system, is completely scalable, with no employee limit. It's currently used by organisations that manage tens of thousands of employees.

Learn more about how we cater for large organisations in the UK, Ireland and internationally.

-

Yes, iTrent meets IR35 payroll requirements. What does this mean for you? An end to payday pain.

People who come under these rules can be entered onto iTrent for the calculation for tax and NI, identified as IR35 cases, and reported to HMRC on the FPS return. iTrent will also reject any attempt to deduct student loan repayments from these people.

Read our blog for more information from our Legislation Manager on IR35.

-

No, this isn't done within iTrent but not to worry. We have a partner solution called PAS Organiser which has a configurable link with iTrent which covers this.

-

Real-time payroll means an end to tedious wait times. Instead of a cut-off period and manually triggering calculation, any changes to an employee's payroll record are visible immediately.

Discover more about real-time payroll.

-

Finding the right payroll software for your business is a game changer. Think about their level of expertise, the customer support available and what their existing clients had to say in their case studies. If this ticks your boxes, then they may be the choice for you.

-

Getting a quote with us is easy, just fill out our form. Pop in some basic information about your business, and we'll be in touch to discuss your options and prices for our payroll systems.

Alternatively, you can contact us directly with any queries about our pricing or services. Our expert team will go above and beyond to find the right solution for you.