Simplify your processes, no matter how complex.

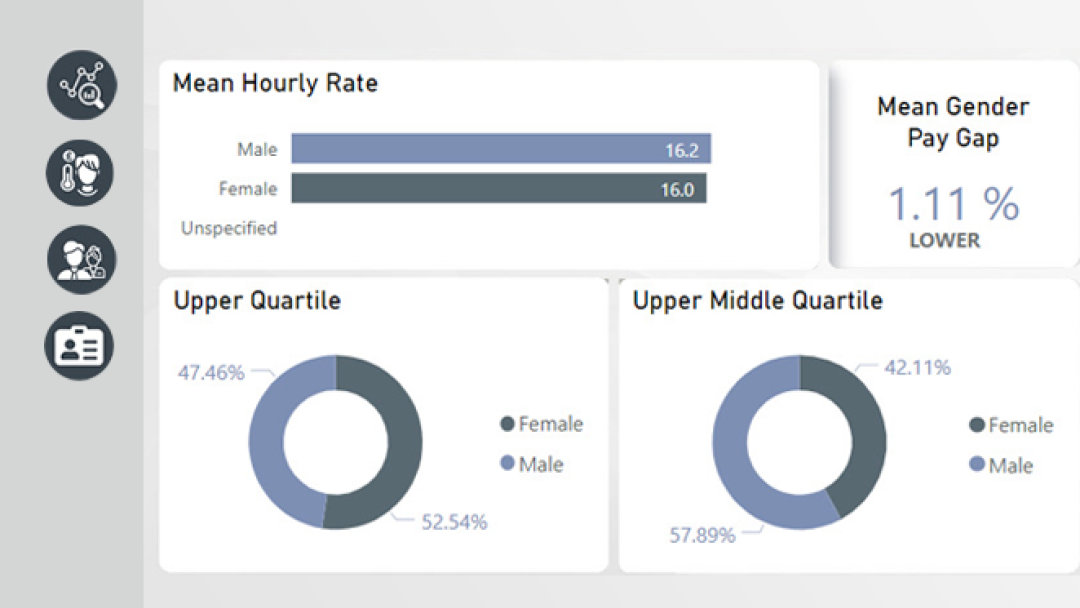

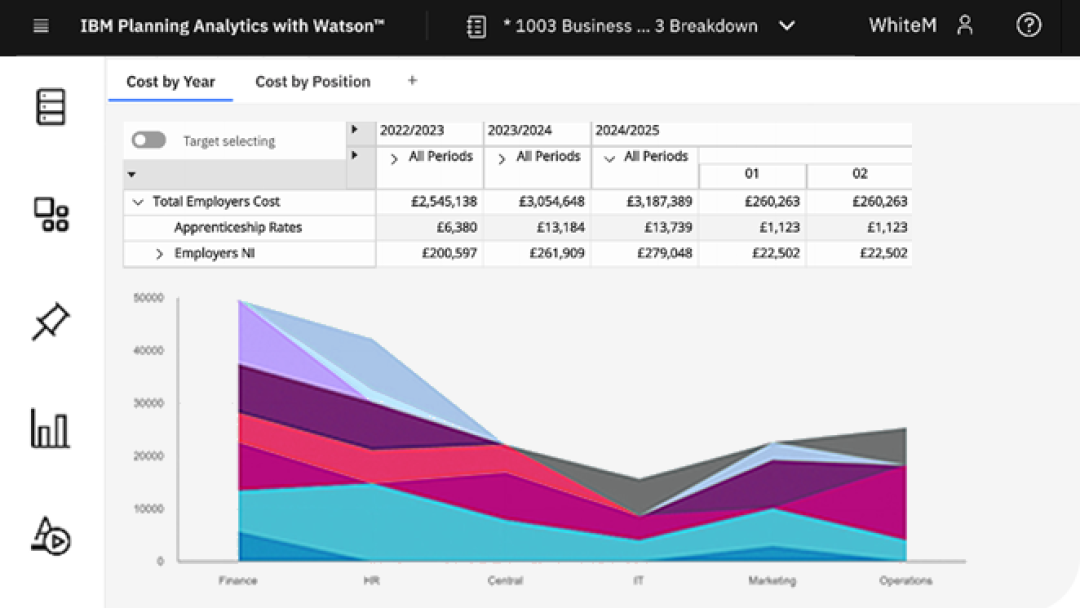

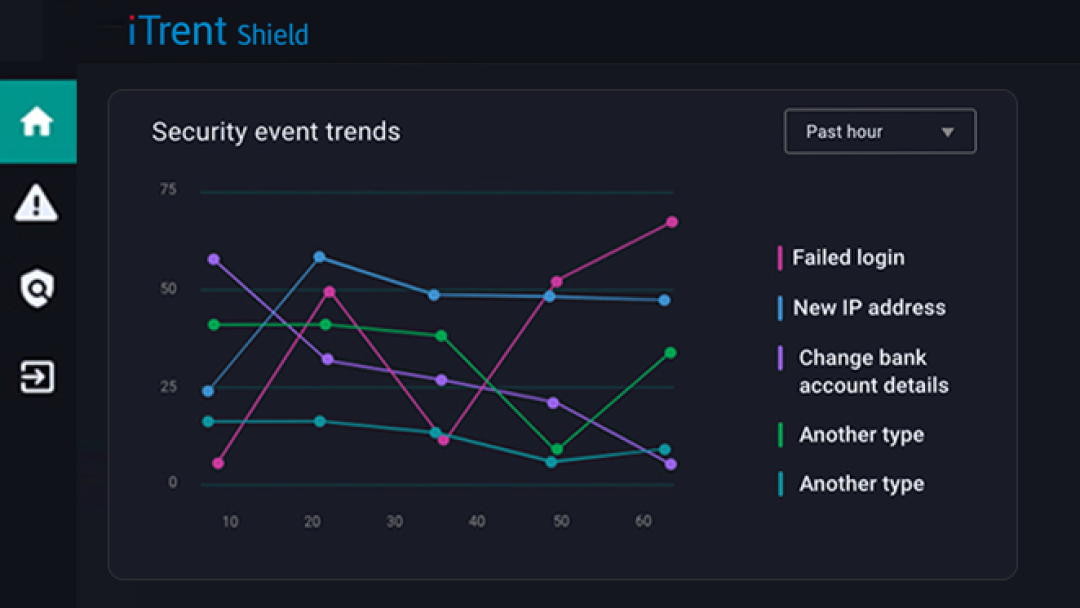

iTrent is a highly configurable HR and payroll system. We've engineered it to accommodate the needs of your organisation, no matter how large or complex. Connected systems, shared data, real-time insights. Put the buzzwords to work for you.