Your workplace needs more WOW. Get ready for MHR's World of Work 2026

Financial transformation

Whether it is finance transformation, digital transformation or digital finance transformation, this is the subject discussed at nearly every finance conference and is the most debated by finance professionals on social media.

Cutting through the hype of Finance Transformation

Whether it is Finance Transformation, Digital Transformation or Digital Finance Transformation, this is the subject discussed at nearly every finance conference and is the most debated by finance professionals on social media. Whilst the immediate focus in the current crisis is undoubtedly on cash, the question of future Transformation is never far from our thoughts.

And yet, despite all this, the feedback that we are getting from many CFOs and other Finance Team members is that they still have elements of uncertainty, whether this is an understanding of Finance Transformation or how it can be delivered to their organisation. Some have expressed that it is “too complicated”, “it is too expensive” and hence “only for big organisations”. In our opinion, much of this is a result of the way that the subject has been explained and presented and who is driving the discussion.

Equipping your organisation for agile planning

This is part one in a four-part series, our objective is to cut through the hype around Finance Transformation and discuss it in a language that we can all understand. We want to help you understand in simple terms what Finance Transformation is and the potential for it within your organisation. Additionally, we want to help you visualise the ‘art of the possible’ through examples of transformation in practice. From this, we hope to show you that every finance team from every organisation can set their own vision for a cost-effective transformation.

Finance Transformation - an introduction and why now?

Let’s start with the dictionary definition of transformation:

"...a complete change in the character of something, resulting in an improvement"

There are two key words in this definition: change and improvement. This is an important point to note as both should apply for transformation to occur.

A simple definition of Finance Transformation derives from this and is:

“…a change and improvement in the performance of the Finance Team”.

When we are using technology as an enabler for this, then digital may be added, extending this to Digital Finance Transformation.

So why is Finance Transformation such a hot topic?

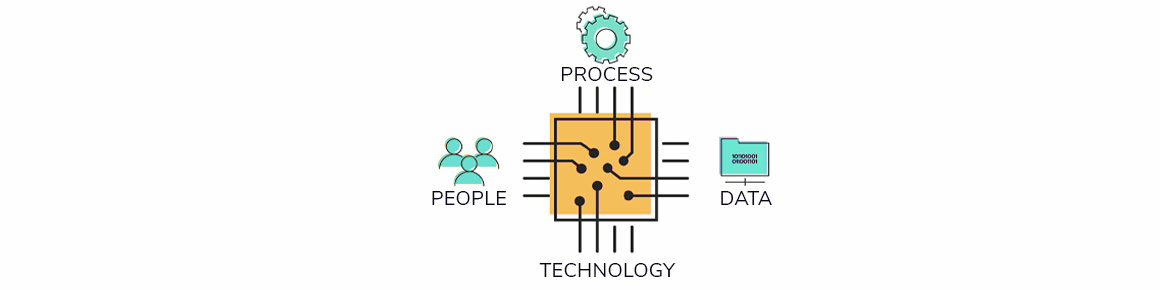

A good starting point to answering this is to re-visit the historical view on delivering change projects. This was based around the ‘People, Process and Technology framework’ - these three components working in balance to drive transformation. This view has now shifted to include Data in this framework. Data is the foundation to delivering insights which lead to actions. Without data there is no point in transformation. Therefore, we now recognise the ‘People, Process, Technology and Data framework’.

There are two major factors influencing the current interest in Finance Transformation. First is massive data proliferation and the drive by every organisation to mine and use it for competitive advantage. This will undoubtedly continue, and Finance Teams need to be at the forefront of making sense of this if they are to add insight and value. In many organisations we are also seeing finance taking a prominent role in data governance.

The second factor is rapid technology advances in recent years, driven by the Cloud and Artificial Intelligence (AI). Cloud can come in several guises and flavours and is now readily accepted by most organisations. Some of the benefits of Cloud are:

-

Immediate (or fast) platform availability

-

Ease of connectivity to disparate data sources

-

Unlimited storage and processing capacity (to deal with data proliferation)

-

Ease of connectivity for users in all locations – allowing better accessibility and increased collaboration

This last point has a significant relevance to the current crisis. Whilst many have struggled to give the finance team access to systems as they transition to enforced homeworking, and maintain productivity levels, those organisations with Cloud deployments appear to have coped much better.

We have seen the use of AI becoming more common in finance in recent years, especially Machine Learning (ML) being used in several ways. This has provided us with more sophisticated capability and intelligence – extending the possibilities for automation of processes, for example around accounts receivable and payable.

This can all be summarised in a current view on delivering change projects that we discussed earlier.

As illustrated in the diagram above, technology is now seen as the platform that: connects People, automates and links Processes, connects to, stores and enables access to Data. Technology provides the platform that enables transformation.

There are some additional factors to consider. Cloud platforms generally have lower upfront costs and are faster to set-up – therefore creating a lower cost of entry. Also, the constant cost pressure and increased demands on the Finance Team – expecting us to do more with less. All these factors, along with the ongoing uncertainty and financial pressures of the crisis, has created a perfect storm that is driving Finance Transformation.

In conclusion

Whilst today your mind may be very much on the current crisis and survival, at some point your thoughts and your planning will start to look to the medium and long term and how your organisation can prepare itself for a future crisis. For many, the importance and need for Finance Transformation will have increased in the past few weeks as they battle to deliver what the organisation needs now in terms of data and planning.

As you can see, when looking at transforming your Finance Team, there should be no barriers to entry. Finance Transformation can be used to describe any initiative or set of initiatives that change and improve your Finance Team. It does not necessarily have to be a large and complex project requiring a coach load of external consultants and costing hundreds of thousands of £s. In fact, articles on how to deliver successful transformation projects advocate a ‘small steps’ approach rather than a ‘big bang’ and a project that is internally resourced.