The all-in-one HCM behind getting things done

Built for people. Designed for impact.

People First is more than just HR software — it’s a smarter way to run your organization.

The all-in-one platform for all your HR needs

Whether you’re managing payroll, hiring top talent or supporting employee growth, People First brings it all together in one intuitive, mobile-friendly solution.

Simplicity at your fingertips

No clutter. No steep learning curve. Just the tools you need — when and where you need them.

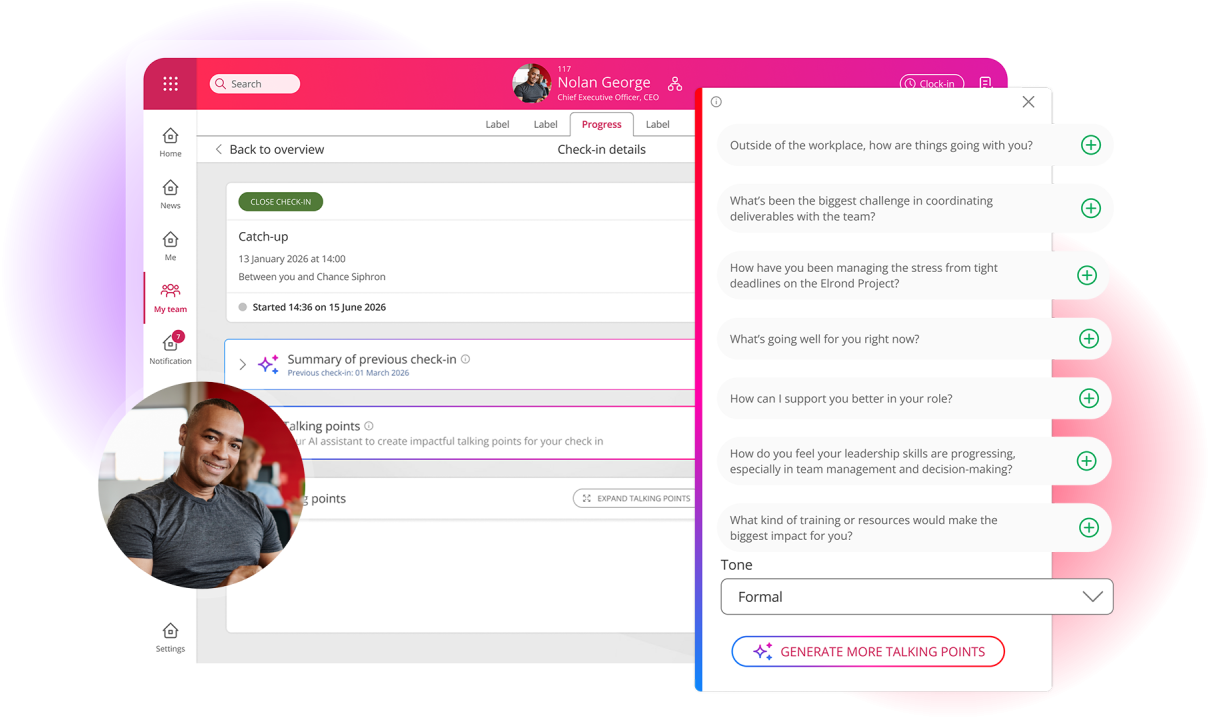

Human-first, AI powered HR

Accelerate everyday HR tasks, amplify employee skills, and augment complex workflows — with AI features designed to make smarter, faster decisions with ease.

Everything you need, all in one platform

-

HR & payroll

-

From employee records and time tracking to fast, accurate payroll, People First centralizes your core processes. Reduce admin workload, ensure seamless compliance and empower HR to focus on people — not paperwork.

-

Talent acquisition & onboarding

-

Attract top talent with frictionless recruiting tools and create lasting first impressions with personalized onboarding experiences. Manage job postings, track candidates and set new hires up for success — all in one intuitive platform.

-

Performance & development

-

Empower managers and employees with structured check-ins, clear goal setting and easy access to learning and development. Keep your workforce engaged, growing and aligned with business priorities.

-

Benefits & wellbeing

-

Streamline open enrollment, benefits management and employee wellbeing initiatives with intuitive self-service tools — giving employees the transparency they need and reducing HR’s workload.

-

Analytics & insights

-

Access real-time dashboards that bring your HR, payroll and performance data to life. Spot trends, drive smarter decisions and deliver powerful insights that move your organization forward.

Take a closer look at the People First HCM solution

Trusted by 1,400+ HR teams

40 year history of serving HR teams

With four decades of experience, MHR is trusted by organizations to simplify and modernize HR - helping teams thrive through constant change.

98% customer retention

Our commitment to long-term partnerships is reflected in our exceptional retention rate, built on consistent service, innovation and a deep understanding of our customers’ evolving needs.

8.5 years average client tenure

On average, customers stay with MHR for nearly a decade - choosing us as a reliable partner to scale with them and meet their goals over the long term.

130+ nonprofit clients

We support over 130 nonprofit clients with HR tools built for lean teams, helping them manage complex, mission-driven workforces efficiently and compliantly.

“It’s going to be a great engagement tool to allow our members to connect with each other, share information and ask questions, having a virtual platform to connect these together is crucial to SHRM Atlanta.”

“With MHR you get a reliable product with great people working within the business.”